How Much Should I Pay a Salesperson? (Building a Salesforce Part 2)

In our previous post, we talked about getting ready to scale your sales team and in today’s post, we’ll look at the actual numbers we have to work with to compensate and motivate salespeople.

The talent-acquisition landscape has changed.

According to one of the largest studies conducted about what employees want, the demands of top talent today are competitive compensation, flexible work-life balance, and work with a purpose.* In light of this, the old 50/50 commission model that the industry has been built on, and one that pits employer against employee (the “sink or swim” model), does not work for this young and purpose-driven workforce.

New talent has higher expectations and they are far less willing to take a 100% commission job. According to ASI’s Promotional Products Sales Compensation Survey, salary-based compensation continues to rise to meet this demand.** We’ve discussed why the 50/50 model is an antiquated model in a previous article (Commission Models and Profitability: Why the 50/50 Split Needs an Overhaul) but now we’ll look at alternative options of compensation to create a thriving sales force.

The obvious challenge is to create a compensation model that is robust enough to attract strong talent, challenging enough to reward growth, and robust enough to add significance to the bottom line. According to Mike Michalowicz in his book Profit First, each business should create targets you should move toward. For example, a good target to aim at, for net profit per sales rep, would be 10% profit (this is our starting calculation, you might want to target a higher percentage or start lower and gradually grow) but the key is to move your current allocation percentage (CAP) to your ideal, targeted allocation percentage (TAP).

A Look at the Numbers

In our previous post, we looked at what an average new salesperson’s growth in the industry looks like, it’s similar to this (note: these are figures for a brand new rep with no existing accounts, we’ll discuss in a subsequent post how to help reps ramp up faster with adequate support, marketing resources, and more.)

Since this is the typical growth pattern for top lines sales growth, we discussed how it takes a few years to "learn and earn" and that a base+salary model is more ideal for cultivating a long-lasting and productive sales team. So, what does a base+ compensation plan and its profitability look like and how do we ensure we are growing and leveraging top sales talent?

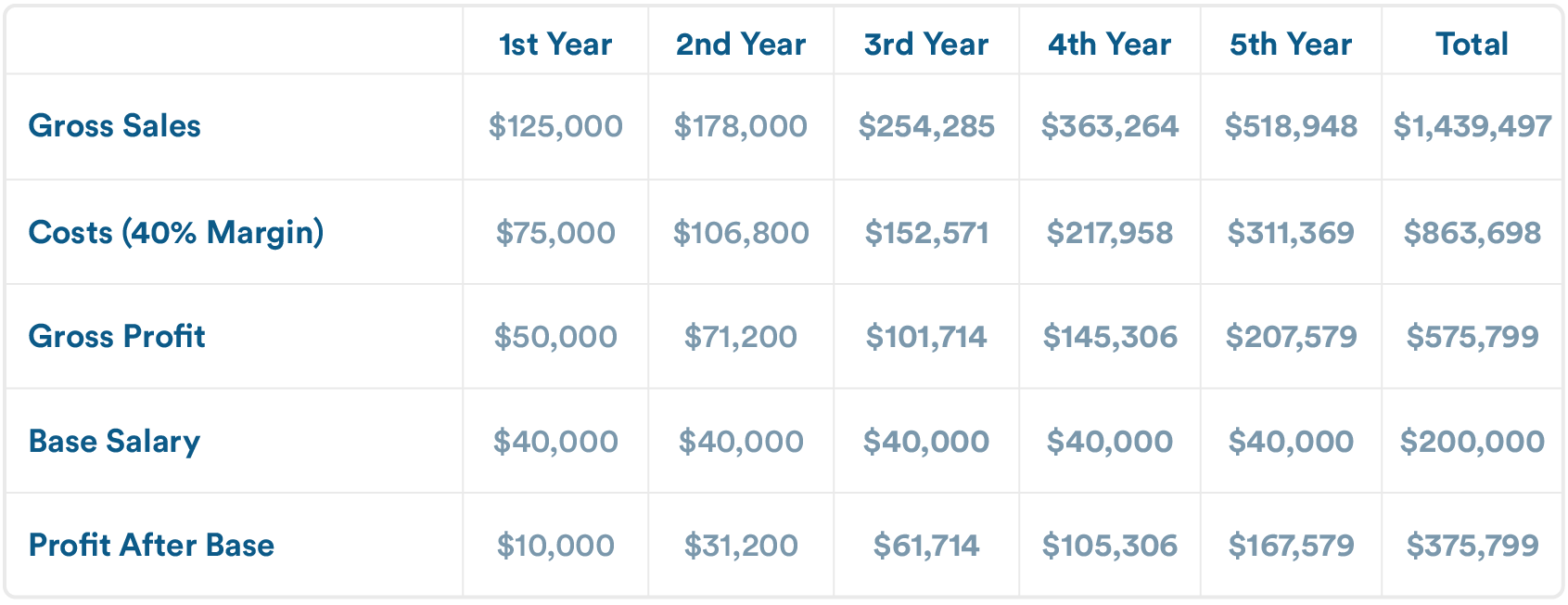

Since we have readers of all types (experienced pros as well as professionals new to the business), let’s make sure we build the basics first. Following is the example of a 5-year sales history with just the sales, the costs, and the gross profit (based on 40% margins).

Now that we know our gross profit is, we know what we have to work with to begin to formulate our compensation plan. Let’s look at what adding a base salary of $40,000 does to our profit (and 40k for a base is not intended to be any kind of metric or benchmark, this is just an example):

Next, what we need to consider is what amount of support costs you should attribute to sales. In the chart below, we have factored in a 10% figure (10% of the top line sales) to allow for your support overhead. This is a general figure but your support costs are critical for sales growth, not only is it imperative that you support a thriving salesforce (we’ll cover best practices for support in a subsequent post) but, it’s important you track those ongoing costs against sales.

So, here’s what profit looks like after a 10% support cost allocation:

In the pink line above, you’ll see the profit we have to work with to now configure an incentivizing compensation package that includes commissions. For example, if you were to consider a flat 40% rate (“flat rate” means that commissions are 40% across the board, whether the salesperson produces $200,00 or $1 million), you can see what this commission plan can earn the sales rep.

Using this as an example, a salesperson at $363k in sales, with a base+commission model can earn $67,592.

One of the biggest questions distributors often ask is, how much profit should you expect to retain from sales? An average figure (remember, this is just an average) is that the house should retain at least 10% of the profits in order to be sustainable and finance future cashflow requirements (and you should increase towards 15%+ as the business scales and cashflow requirements grow). When you consider the compensation package above (base+commissions), you’ll see that the numbers in the line “net profit” begin to equal very closely to our averaged expectation of 10% profit to the house after you climb out of the first few investment years, and then the profit increases past 10% after year three.

By factoring in a 10% minimum of net profit that the house should retain (after overhead), you’re close to developing an incentivizing package that works for both you and the rep, with the rep and the house beginning to see a return on their mutual investment by year three, certainly by year four.

When the investment pays off for you depends on your creative compensation, and there are many ways to build a compensation plan. A few other examples of commission plan options are options that are configured by a flat percentage on the gross margin only. In this example, we’re using a base+commission model with a simplified formula of 10% of the gross margin going to the rep. This type of calculation is an easy way for the rep to process and understand their earnings without all the complicated calculations.

What I love about a "flat percentage of gross margin" is that this keeps the rep focused on profit and gives them an easy, quick calculation to come up with earnings.

The small-but-crucial benefit you get from a simplified formula like this is that the rep is able to calculate, in their head and on the fly, what each sale can earn them, which becomes a mini-incentive boost built into each sale. Another example is a commission plan that grows with each successful year, a sliding scale commission plan. An example of a sliding scale commission plan that rewards growth might look like this: 1st year: Base only

2nd year: Base + 25% commissions

3rd year: Base + 30% commissions

4th year: Base + 35% commissions

5th year: Base + 40% commissions

And one more example is that of a base salary that reduces as sales increase, providing the rep with a stable enough income to "learn and earn" until they have the stability of steady-producing accounts. Many distributors want to know the success formula for sales compensation success and though no such formula exists, there are principles we can use to guide us.

Each market is different (San Francisco is a different competitive landscape than is Duluth), each distributor’s support infrastructure and financial needs are different, each distributor’s business goals are different, and each distributor has their own unique value proposition (or lack thereof). Though you can’t layer someone else’s compensation plan over yours and guarantee success (there are too many variables), you can implement key ideas and create a compensation model that fit right for you and your business objectives.

We’ve just cited a few examples for you to consider as you build your plan. In our next post in this series on building a successful sales team, we’ll cover the three critical KPI’s you should consider as you build your plan.

All of the formulas above are built into this spreadsheet that you are welcome to download.